TAKE YOUR FREE Market Readiness Assessment:

The Class VI Business Health Assessment is more than a traditional valuation tool—it is a comprehensive, patented assessment. Drawing on thousands of data points from mid-market transactions, our proprietary algorithm supplies insights into what your company is worth—and most importantly, why.

- Calculate an accurate company valuation

- Identify key factors that could kill a potential deal

- Learn what key actions you should focus on first to improve the business in ways investors care most about

- Determine your MarketValue Score, showing how you stack up against same-category competition

- Use your MarketReady Rating to understand whether you’re prepared for a transaction

- Receive detailed analysis of all factors impacting your value and a growth map of next steps

Plot your current location and map your route to exit

The patented Business Health Assessment is based on hundreds of actual company sale and capital raise transactions. Dive deep into 7 core investor priorities to determine strengths and weaknesses and then chart a course to maximum value.

Customers

Organization

Team

Strategy

Market

Growth

Finances

Your assessment, made easy

Most online valuation tools translate simple inputs, such as your industry and revenues, into an arbitrary and often highly inaccurate valuation estimate.

The Class VI Business Health Assessment is different. It examines over 90 risk factors that affect value and marketability and delivers actionable insights to help you reach the destination you envision.

It starts with a 30-minute strategy call, and the process is free.

STEP 1: Answer a few questions

Give us about 30 minutes of your time to answer a series of multiple-choice questions.

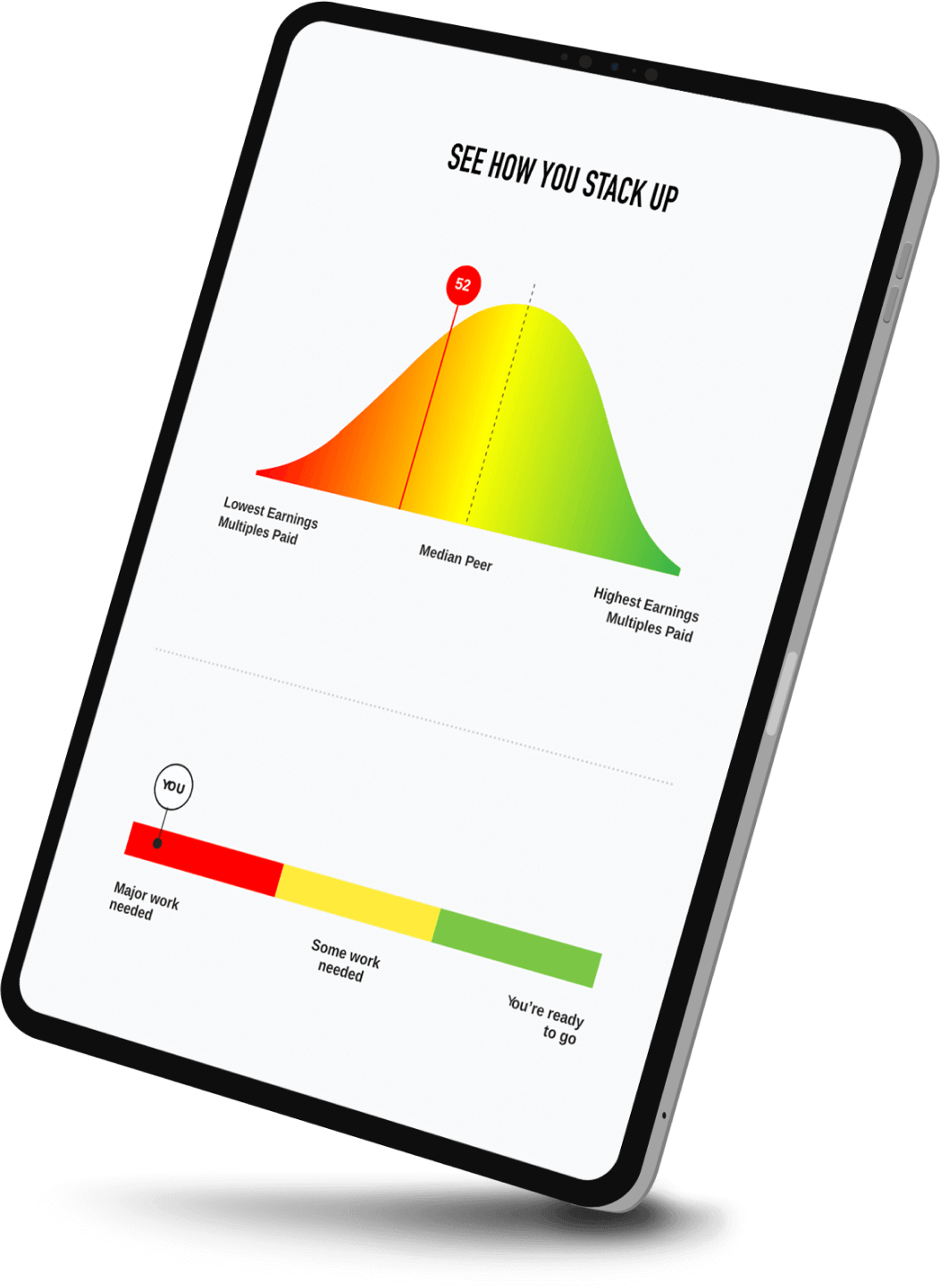

STEP 2: See how you stack up

Our patent-pending algorithm shows how your company’s valuation compares to your peers and assesses whether you’re ready to sell.

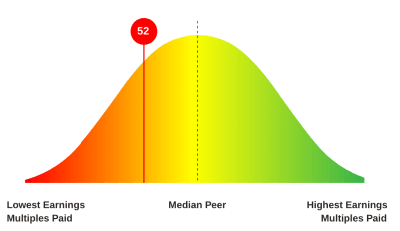

MarketValue Score

The MarketValue Score tells you whether your company would likely be valued higher, lower, or about the same as comparable companies.

MarketReady Rating

The MarketReady Rating tells you whether your company is ready to sell.

STEP 3: Identify your prioritized list of critical risks

We deliver a prioritized list of issues and risks that need to be mitigated before connecting with investors or buyers – some will be expected, but others may surprise you.

STEP 4: Create a plan and get to work

Receive customized business solutions so you can get started.

It’s much more than a business valuation tool.

We deliver:

See how your business is perceived by investors.

Prioritization

Identify risks and corresponding solutions, in order of priority, to enhance value.

Peer-to-peer evaluation

Learn how you stack up against your market peers.

Market Readiness

Find the optimal time to go to market.

Understanding

Know what conditions are increasing or decreasing your value (and why they matter).

Peace of mind

Take action to create a strong, healthy company, whether you decide to sell or not.

What our users have to say

You’ve got questions? We’ve got answers.

Failing to plan is planning to fail. Even if you are not looking to sell your business for several years, we recommend our clients take steps to prepare their business ahead of time – in nearly every case, this foresight pays off in a big way during the ultimate sale.

Understandably, many active entrepreneurs view their company through “business owner goggles” versus “investor goggles”. This is why we have developed the business health inventory and Pathfinder. The sooner you start to prepare yourself and your company for maximized value in the eyes of an investor, the less time, money, and energy you will have to spend when you are ready to go to market.

You will end up with much more money, much less suffering, and you will never feel like you were taken advantage of if you are educated, prepared, and knowledgeable. You are about to engage in a game with professionals on the other side — don’t wait to start your training.

Not at all. While the business health inventory will help companies positioning to sell in the future, the assessment will also help any company identify invisible risks, develop plans to address those risks, and in the process make the company healthier, allowing its owners to rest easier.

As an entrepreneur, you have been conducting negotiations with suppliers, customers, and distributors for years or, in some cases, decades. Yet, selling your company is likely the most important and complex deal you will ever close. Consequently, the value that can be left on the table and the time and money that can be wasted without the support of an experienced M&A team can be substantial.

Depending on your deal size, a business broker may be an appropriate option if your deal size is expected to be less than $10 million. For companies with an expected value above $10 million, we recommend engaging with an investment banker to maximize your value. The fees associated with a deal team of investment bankers, attorneys, and accountants can seem exorbitant at first glance. However, we have yet to hear a client express that the value of their deal team didn’t pay for itself by the end of the process (often times many times over). Just as your surgeon, pilot, or plumber could tell you, some things in life are worth going with the pros!

The business health inventory comes with its own instructions on what both the MarketValue™ and the MarketReady™ scores mean, as well as how to use the prioritized list of business risks proprietary algorithm generates.

The business health inventory is not a canned or generic valuation tool. Our core belief is that valuation tools that do not ask detailed, follow-up questions are dangerous and give a business owner a false sense of certainty. Business valuation is really not this simple.

The inventory was designed not to give an arbitrary valuation based on some simple inputs, but rather provide a deep-dive into the different risk factors that could impact a company’s value or marketability. It will also help business owners develop plans to address specific risks, thereby increasing company value.

Your MarketValue™ Score represents how a company’s value would compare to its peers, and is based on specific questions related to valuation only. The MarketReady™ Readout is an indicator of whether a company is ready to go to market to sell — i.e., does the business have risks or issues that would get in the way of getting a deal done or materially interfere with a transaction?

The business health inventory will allow a business owner to see what might be “invisible” today and provide an objective “investor’s view” of his or her company. When inherent risks are revealed in their business and a game plan is developed to address and resolve those risks, it provides a business owner peace-of-mind and the company will be more valuable — sometimes millions of dollars more valuable.

A one-off process can be great for a business owner, but without a competitive process to produce several offers, they will not know for sure if they were able to maximize the value of their company.

We have worked in one-off deal scenarios before and while it doesn’t give you the benefit of time to prepare or market context, having an investment bank involved can literally be worth millions. If you are approached with a one-off offer, we recommend the first thing you should do is call a reputable investment banker and start the conversation around the buyer and their interest, and examine what works best for you from there.

Conversely, a banker-led process means your business will be prepared in advance to endure the rigors of due diligence, and you will have talked with, and ideally received bids from, several interested buyers. Having this level and diversity of interest means you have several options in case your initial option as a buyer falls through. It also means those buyers are going to be putting their best foot forward, just as you would with a potential customer if you knew the process to get that customer was competitive. By having these options, your odds of getting a deal done increase significantly, and your valuation will almost certainly be higher than if you were to simply go down the path with one bidder.

Comparable peers for most companies represent companies in their revenue size range — our intent is to start to refine comparable peers by industry in a future release.

Not in most cases. While some questions ask about basic financial metrics, they are high-level and should not require a CFO or Controller to answer.

Yes. Every business health inventory and its corresponding report are secure. Without user permission, the business health inventory does not use any individual company’s information other than on an aggregated basis to perform aggregated analytics, trending, benchmarking and analysis.

In addition, company names will not appear on the business health assessment report so there is little risk of someone inadvertently associating a report with any specific business.

The business health inventory utilizes a proprietary patent-pending algorithm to score a user’s Assessment based on question answer scoring, weighted questions, and prioritized risks. Not every question is equally important, and not every risk is equally impactful on valuation. This algorithm is based on years of experience buying, selling, operating, and advising companies in the private capital markets, as well as thousands of conversations with professional investors.

After receiving the business health inventory report, a CEO or owner might decide that: 1) professional help is needed to develop a plan in order to address specific risks in preparation to go to market, or 2) assistance in taking a company to market is needed. Class VI offers these services – however, we take a strict “no sale” approach and are quite happy if lots of companies simply get their own value out of the business health inventory report.

Any business health inventory user needing additional help reviewing their report or developing a specific plan to address risks in preparation of a transaction should reach out to chris@classvipartners.com. However, please know there is no obligation to do so.

Yes. We are working on enhancements and tools users will be able to utilize to help them better operate their companies. These enhancements will include benchmarking tools, financial analytics tools, prioritization tools and exercises, a personal financial health inventory, and key performance indicators.

In addition, we will be constantly producing content we think will be valuable for our national organization partners and their members.

It’s our recommendation and policy that registered users take the assessment once annually to track progress and aid in strategic planning.

While the business health inventory can help non-profits identify certain organizational risks, several elements of the platform will not be applicable for non-profits. However, the business health inventory would be valuable for a non-profit looking for an external assessment to reveal critical aspects of their organization.

The business health inventory is not offering private licensing currently. We will continue to think about how to best support a licensing plan but are focused on making the business health inventory a great application and aide to business owners first. Please check back soon for updates!

The business health inventory is based on over 70 years of combined operations and industry experience. The principals at Class VI have run organizations ranging from $2 million to over $1 billion in revenues and have completed well over 100 transactions.

The business health inventory has also been reviewed by several investors, providing product viability as well as a confirmation of the results produced by our proprietary algorithm. It is important to understand that the business health inventory is meant to be a directional tool – directing business owners to specific risks in their business and helping them prioritize what to work on first.

Many business assessment tools in the market lack the detailed approach necessary to provide business owners with the comprehensive risks and strategic plan to truly impact the valuation of their company. In addition, many online tools derive revenue from licensing to third-party consultants or other service providers seeking to use the tool to obtain a consulting engagement.

The business health inventory does not license its application or customer data and does not provide referrals to any outside service providers. The business health inventory is designed to be a comprehensive assessment that business owners and CEOs can use on their own, with guidance on what to do to start to increase value. The highly customized strategic plan the report curates is designed to be self-driven rather than pushed to a consultant looking to generate additional fees.

In summary, the business health inventory differentiates itself by offering the following and more:

- Provides detailed analysis of business risks that impact value

- Uses an algorithm based on hundreds of actual transactions

- Provides detailed suggestions on how to address risks

- Prioritizes the risks owners should focus on first

- Compares a user’s company to its peers

- Identifies key risks that would kill a potential deal

- Helps you put your plan into action

- Uses a patent-pending algorithm to weight your individual risks

What the business health inventory WON’T do:

- Ask for detailed, private financial statements

- Use generic industry valuation multiple formulas

- Send leads to unaffiliated third parties

- Bombard your inbox with frivolous offers or third-party product